Case Study: Children’s Hospital Use Cases

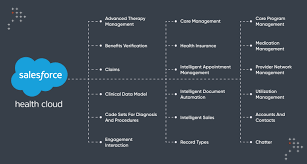

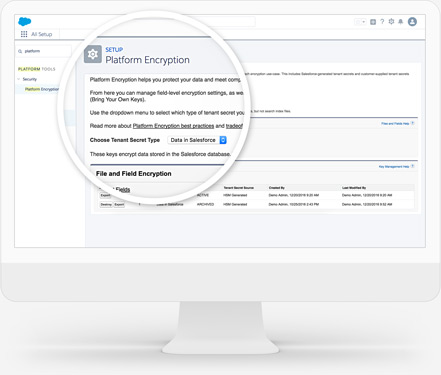

In need of help to implement requisite configuration updates to establish a usable data model for data segmentation that supports best practices utilization of Marketing Cloud features including Contact Builder, Email Studio and Journey Builder.