MCG and Salesforce Health Cloud

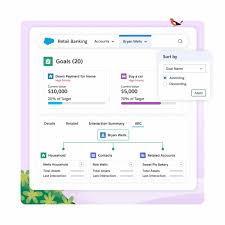

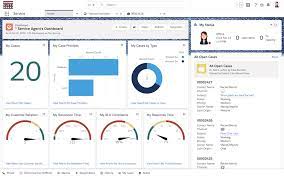

MCG Health Integrates with Salesforce Health Cloud to Enhance Chronic Care Management SEATTLE, Aug. 27, 2024 /PRNewswire-PRWeb/ — MCG Health, a leading provider of technology-enabled, evidence-based guidance and a member of the Hearst Health network, has announced a new integration with Salesforce Health Cloud. This integration is designed to improve the management of patients with chronic conditions and those transitioning between different care settings, such as ambulatory care, recovery facilities, or home care. By combining the #1 AI-driven customer relationship management (CRM) platform with the healthcare industry’s most trusted evidence-based guidance, this partnership aims to streamline and enhance patient care. Salesforce Health Cloud’s Integrated Care Management (ICM) feature now incorporates MCG’s Chronic Care and Transitions of Care guidelines in an interactive format. This powerful combination of technology and clinical decision support optimizes and simplifies care planning for patients as they move through their post-acute journey. The integration offers tools to identify patient needs related to social determinants of health (SDOH) and includes branching logic to accommodate individual patient situations. This innovation is expected to significantly reduce administrative burdens for hospitals and health plan staff while promoting evidence-based care management for patients with chronic conditions and those requiring transition management. Additionally, patient education materials from MCG Health can now be easily sent to patients directly from within Salesforce Health Cloud, enhancing their understanding of diagnoses and treatment options. “This integration further enhances our ongoing collaboration with MCG and brings greater return-on-investment to our Health Cloud customers by focusing on delivering patient-centered and evidence-based disease management,” said Amit Khanna, Senior Vice President and General Manager of Health at Salesforce. Jon Shreve, President and CEO of MCG, added, “Our collaboration with Salesforce Health Cloud introduces a powerful, evidence-based tool for managing chronic disease. This integration allows MCG to assist Salesforce’s healthcare customers in streamlining their care planning and disease management programs. The solution not only improves adherence to evidence-based practices but also enhances clinical workflows, benefiting healthcare organizations and, most importantly, the patients.” Amit Khanna of Salesforce reiterated, “We are excited to integrate MCG’s trusted, evidence-based guidance into Health Cloud, further advancing the care of patients with chronic and complex diseases. This integration enhances our existing work with MCG, providing more value to our Health Cloud customers by emphasizing patient-focused, evidence-based disease management.” Those interested in learning more about this integration can request a demo from MCG at this link. About MCG HealthMCG, part of the Hearst Health network, offers unbiased clinical guidance that empowers healthcare organizations to deliver patient-centered care with confidence. By combining artificial intelligence and technology with clinical expertise, MCG helps clients prioritize and simplify their work, leading to improved clinical and financial outcomes. MCG also provides world-class customer service, ensuring that clients fully benefit from their solutions. For more information, visit MCG Health. About Hearst HealthHearst Health’s mission is to guide critical care moments by delivering essential information to everyone involved in a patient’s health journey. Hearst Health’s care guidance impacts the majority of people in the U.S. and includes a network of companies such as FDB (First Databank), Zynx Health, MCG, Homecare Homebase, and MHK (formerly MedHOK). Hearst also holds a minority stake in Aster Insights, a precision medicine and oncology analytics company. Follow Hearst Health on X @HearstHealth and LinkedIn @Hearst-Health. Like Related Posts Health Cloud Brings Healthcare Transformation Following swiftly after last week’s successful launch of Financial Services Cloud, Salesforce has announced the second installment in its series Read more Salesforce Government Cloud: Ensuring Compliance and Security Salesforce Government Cloud public sector solutions offer dedicated instances known as Government Cloud Plus and Government Cloud Plus – Defense. Read more PII Explained Personal Identifiable Information (PII) is defined as: Any representation of information that permits the identity of an individual to whom Read more Case Study: Health Payer/Provider Onboarding/Network Growth After doing their initial Sales Cloud implementation and SAP integration over 12 years ago, this company was only leveraging Salesforce Read more