According to CBInsights, based upon research conducted by analyzing earnings calls, business relationships, and investment activities to assess the AI initiatives of some of the world’s largest companies across various sectors. Generative AI for Insurance and Financial Services is growing rapidly.

The latest research report from the CBInsights team highlights the undeniable significance of AI for many of these global giants. Salesforce CEO Marc Benioff, for instance, referred to AI as “the single most important moment in the history of the technology industry” during the company’s recent earnings call.

JPMorgan CEO Jamie Dimon echoed this sentiment in his April 2024 letter, expressing strong conviction about the extraordinary consequences of AI.

Several companies are strategically focusing on AI to drive efficiencies and innovation. For instance, major pharmaceutical firms are collaborating on AI-powered drug discovery projects to expedite drug development timelines, while payments giants are deploying AI to combat fraud effectively.

Despite the hype surrounding recent advancements, the translation of AI innovations into revenue has been limited so far. However, companies remain optimistic about future opportunities, recognizing the imperative of taking proactive steps to reshape industries.

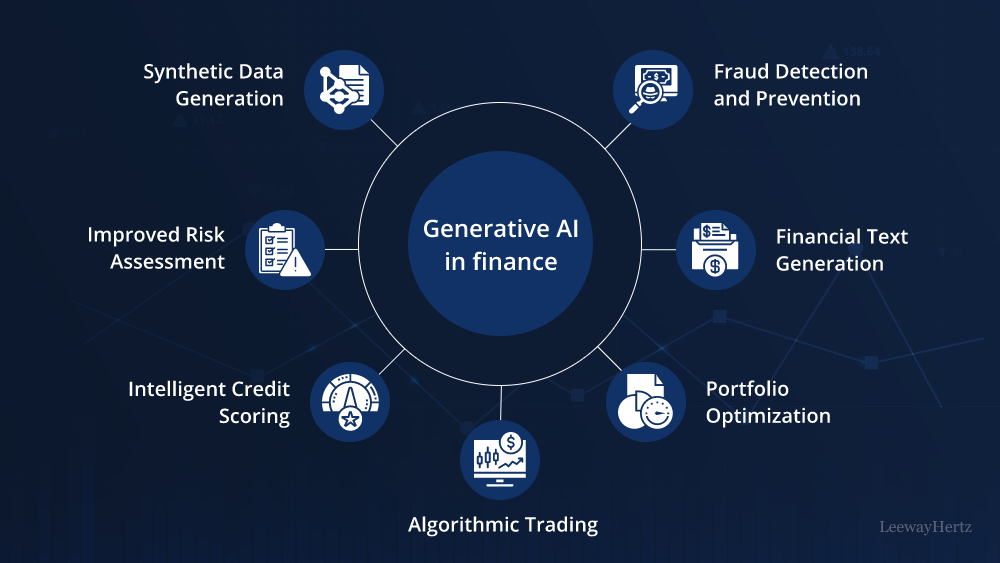

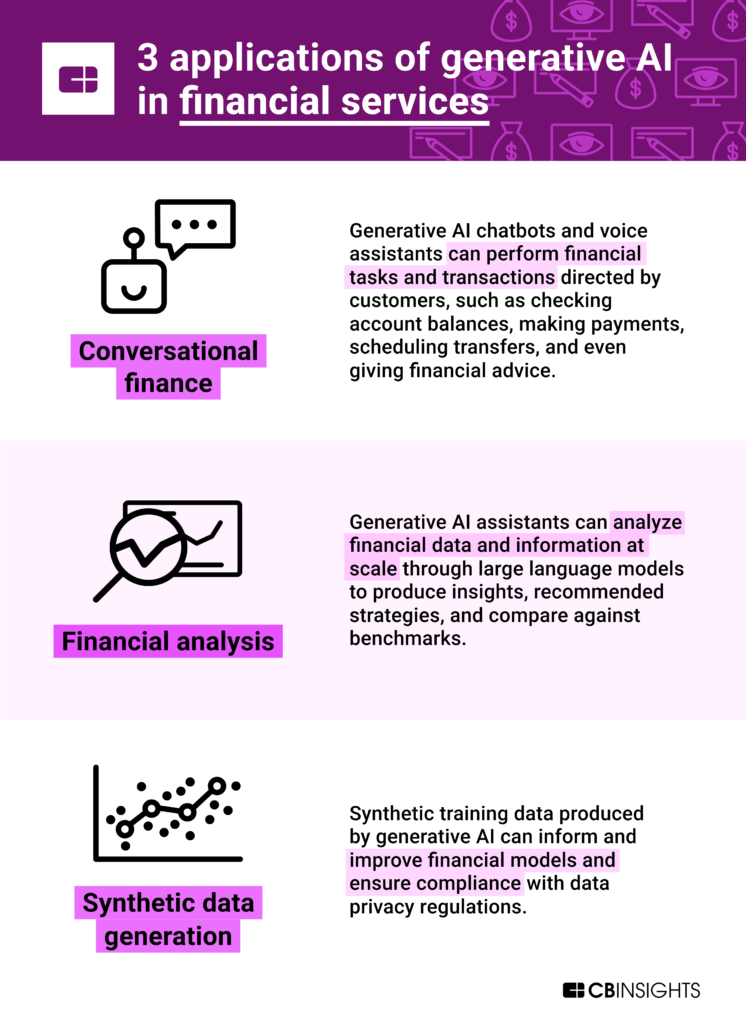

Generative AI for Insurance and Financial Services

CBInsights’ comprehensive report digs into the AI strategies of various companies across sectors such as financial services, insurance, enterprise tech, pharmaceuticals, and industrials. By leveraging the CB Insights technology intelligence platform, they have analyzed signals like investment, partnerships, executive discussions in earnings transcripts, and patents to gain insights into these efforts.

AI and machine learning algorithms are increasingly being utilized to enhance digital identity and regulatory technology (Regtech) services, as well as to improve customer experience through AI chatbots.

In the financial services sector, advancements in AI technology are making services more accessible and frictionless, empowering investment platforms to automate tasks and focus on critical product development endeavors. While AI is still evolving, it is expected to play a pivotal role in driving the digital economy forward in the near future.