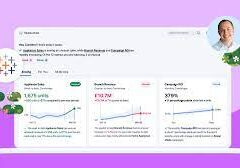

Salesforce has unveiled a comprehensive analytics solution tailored for wealth managers, home office professionals, and retail bankers, merging its Financial Services Cloud with Einstein Analytics. This amalgamation, known as Einstein Analytics for Financial Services, harnesses Salesforce’s robust query engine and interpretation layers, fueled by the enterprise data analytics prowess acquired through BeyondCore in 2016. Salesforce Unites Einstein Analytics with Financial CRM

This integrated platform – Salesforce Unites Einstein Analytics with Financial CRM – offers two prebuilt analytical models, meticulously designed to gauge client churn (identifying clients at risk of leaving) and the potential for clients to bring additional assets to a firm. These models, while prepackaged, can be tailored to specific needs, providing insights into future scenarios within the firm. Advisors can leverage these models to assess client characteristics against firm-wide benchmarks and receive actionable suggestions to enhance client retention.

Home office professionals and data scientists have the option to delve into the underlying mathematical frameworks of these models, allowing for customization if required. While the tool offers enterprise-level benchmarking, firms can incorporate their own industry-specific data to run the models, ensuring tailored insights.

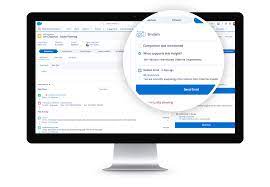

This initiative builds upon previous endeavors integrating machine learning into Financial Services Cloud, which aimed to identify crucial life events and offer actionable recommendations. The decision to develop a more holistic solution stemmed from observing customer behavior and the growing trend of custom dashboard creation. By streamlining and prepackaging these insights, Salesforce aims to accelerate adoption and empower users to focus on their core tasks.

Although customization remains a key feature, the platform aims to simplify adoption by providing templated solutions. However, the efficacy of insights depends on the quality of the ingested data, emphasizing the importance of data aggregation and normalization. Future updates are expected to introduce additional machine learning models focused on reducing heldaway assets and increasing assets under management.

Developed in collaboration with diverse stakeholders, ranging from enterprise financial advisors to firms of varying sizes, the service is priced at $150 per user per month. It’s not a standalone product and requires integration with Financial Services Cloud or Einstein Analytics Plus.