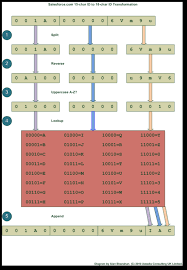

Key Dates for the Winter ’25 Release Winter ’25 is Approaching! Can you believe it’s that time of year again? Salesforce is gearing up for its most anticipated release of the year, and Demand Chain is here to assist you in getting ready. There’s a lot to explore, so grab your coffee (or your preferred caffeinated beverage) and let’s dive in! Starting August 8, 2024, admins can sign up for a pre-release Developer Edition environment to access new features. Be sure to check out the Release Notes available from August 14, 2024, to stay updated on the latest enhancements for the products you use. Each release includes a Sandbox Preview Guide to help you determine the best next steps for your sandbox environment. The Sandbox previews, which began on August 30, 2024, allow you to test, identify, and report bugs before the major release hits your production instance. Let’s work together to ensure we’re “Release Ready”! Admin Insights User Access Summary To streamline the process of determining user permissions, administrators can now easily view all permissions granted to a specific user in just a few clicks. The “Access Granted By” feature, introduced in Spring ’24, is enhanced in Winter ’25 to show the specific sources of a user’s access. Inline Editing with Enhanced User List View With the Winter ’25 release, you can configure user list views just like any other list view in Salesforce. Now, you can view, sort, filter, and modify user records directly within the list view without navigating away. Conditional Formatting for Fields Conditional formatting can now be applied to fields on pages with Dynamic Forms enabled. Using rulesets, you can customize icons and colors based on specific criteria related to field values. Enhanced Custom Report Setup (Beta) Enhance your custom report types with the redesigned Custom Report page in Setup. The new summary page offers greater flexibility and visibility into report details, with features like drag-and-drop sections, field search, name customization, and the Lookup Fields button for adding up to 1,000 fields to the report type layout. Sales Cloud Updates Optimize Strategic Planning with Account Plans Empower your sales team to take a strategic approach to account planning and growth. Account plans allow you to view opportunity details, conduct a SWOT analysis, capture customer needs, set measurable objectives, and visualize key stakeholders. Seller Home Available for All Apps Seller Home now provides your sales team with a comprehensive view of their business and can be added to any standard or custom app with the Winter ’25 release. Forecasting Enhancements Service Cloud Innovations My Service Journey (Beta) Explore Service Cloud with My Service Journey, where you can discover relevant capabilities and filter by business areas, Salesforce edition, and new features. If you find something of interest but lack access, you can easily contact your Salesforce Account Executive directly from the platform. Enhanced Messaging Channels and Capabilities Salesforce has broadened its messaging options to include additional channels like LINE Messaging, Bring Your Own Channel (BYOC), BYOC for Contact Center as a Service (CCaaS), and Unified Messaging for SMS. Flow Updates Flow Action Buttons Now Generally Available With the removal of the beta flag, Flow Action Buttons can now be disabled based on specific criteria. Flow Repeater Enhancements Improve user experience by prepopulating data within screen flows, allowing users to easily change a collection of records. You can also control whether users can add new items. Transform Element Enhancements New data types (e.g., Boolean, Date, Picklist, Text) are now available for use as Target Data values. Developer Insights Real-Time Preview of Lightning Web Components Developers can now preview Lightning Web Components in real-time by enabling Local Dev (Beta) in their developer sandbox. Changes to the source code will automatically update the preview, eliminating the need to refresh manually. Manufacturing Updates Inventory Search and Transfer Empower inventory managers to maintain optimal levels, fulfill product demands, and enhance inventory processes by easily searching and tracking stock across various locations. Consider Decimal Values for Forecasts Accurately forecast quantities with new decimal fields on Sales Agreements, supported by a new node in the Data Processing Engine templates. AI/Data Cloud Highlights The Winter ’25 release introduces a variety of new and enhanced Einstein AI features, transforming how businesses leverage artificial intelligence. Salesforce Einstein is leading the way with tools that boost productivity, enhance customer engagement, and facilitate data-driven decision-making. Main Einstein Feature Summary Table The release notes highlight key Einstein AI features across various clouds, such as Communications, Education, Field Service, Industries, Marketing, Sales, and Service. Features like Einstein Quick Quote, Alumni Metrics, and AI-driven insights are designed to enhance productivity and decision-making. Einstein Personalization: Data Cloud Einstein Personalization works with Data Cloud to deliver personalized experiences across Salesforce clouds. Customized Work Summaries in Copilot You can now tailor how Einstein drafts Work Summaries in Copilot by setting your formatting rules or restrictions for the prompt template. Sales Signals Sales managers and teams can access enhanced features from Sales Signals, including relevant metrics, key themes, and featured mentions. The revamped Signals page matches the updated ECI interface, providing more metrics and relevant data. AI Enhancements to Emails AI-driven improvements are being introduced in areas of Salesforce where emails are generated. Flow Builder Enhancements The release includes several AI enhancements to the Flow Builder, improving how flows are constructed and optimized. AI Accelerator and Scoring Framework Utilize AI Accelerator to obtain predictions across multiple Industry clouds, enabling the creation of generic propensity models without coding by leveraging the Scoring Framework. Like Related Posts Salesforce OEM AppExchange Expanding its reach beyond CRM, Salesforce.com has launched a new service called AppExchange OEM Edition, aimed at non-CRM service providers. Read more The Salesforce Story In Marc Benioff’s own words How did salesforce.com grow from a start up in a rented apartment into the world’s Read more Salesforce Jigsaw Salesforce.com, a prominent figure in cloud computing, has finalized a deal to acquire Jigsaw, a wiki-style business contact database, for Read more Health Cloud Brings Healthcare Transformation Following