360 SMS

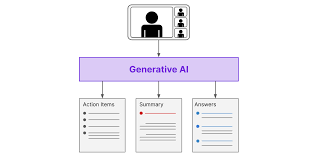

360 SMS: Revolutionizing Communication on Salesforce Built natively on the Salesforce platform, 360 SMS is a powerful messaging app that enables seamless communication with customers, prospects, and business partners across the globe. Whether sending single or bulk SMS/MMS, this app empowers teams to connect effectively while leveraging Salesforce’s capabilities. Its innovative features, such as automation, SMS templates, and URL shortening, make it a top choice for businesses seeking efficient and cost-effective communication. 360 SMS stands out as the “Top-Ranked Salesforce Messaging App” due to its versatility, ease of use, and advanced features. By enabling businesses to reach more clients with concise, impactful messages rather than long emails, 360 SMS drives engagement and enhances customer interactions. Additionally, businesses can save on SMS costs by utilizing shortened URLs, maximizing the efficiency of their Salesforce messaging campaigns. Build No-Code Salesforce Chatbots with 360 SMS Creating Salesforce chatbots no longer requires coding expertise or reliance on developers. With 360 SMS, businesses can easily configure no-code chatbots to automate tasks such as lead qualification, customer support, and answering FAQs. This streamlined solution helps enhance customer engagement and optimize workflows. The Salesforce chatbot integrates seamlessly with Salesforce, ensuring that all interactions are logged and accessible within the CRM for easy tracking and follow-up. It supports consistent, efficient communication across multiple touchpoints, enabling businesses to scale their customer support and sales operations effortlessly. Beyond Salesforce: No-Code Chatbots for Any CRM or Industry 360 SMS goes beyond Salesforce, offering drag-and-drop tools to create custom texting chatbots for other CRMs and industries. These chatbots support 11 built-in communication channels, allowing businesses to centralize their interactions and automate two-way communication effectively. Easily Configure Salesforce WhatsApp Chatbots WhatsApp, one of the most widely used communication platforms, is now easier than ever to integrate with Salesforce using 360 SMS. This no-code WhatsApp chatbot solution enables businesses to automate tasks such as customer support, lead qualification, and sales inquiries—all directly within the Salesforce ecosystem. By automating routine tasks like answering FAQs or guiding customers through product inquiries, businesses can improve response times and maintain meaningful customer connections. The chatbot logs every conversation in Salesforce, ensuring full visibility for tracking and follow-up. With 360 SMS, setting up a WhatsApp chatbot becomes a hassle-free process, delivering powerful automation without the need for coding expertise. 360 SMS: Your Partner in Smarter, Scalable CommunicationWhether you’re looking to optimize customer support, drive engagement, or enhance sales, 360 SMS empowers businesses with the tools they need to succeed—all while reducing costs and boosting productivity. Like Related Posts Salesforce OEM AppExchange Expanding its reach beyond CRM, Salesforce.com has launched a new service called AppExchange OEM Edition, aimed at non-CRM service providers. Read more The Salesforce Story In Marc Benioff’s own words How did salesforce.com grow from a start up in a rented apartment into the world’s Read more Salesforce Jigsaw Salesforce.com, a prominent figure in cloud computing, has finalized a deal to acquire Jigsaw, a wiki-style business contact database, for Read more Health Cloud Brings Healthcare Transformation Following swiftly after last week’s successful launch of Financial Services Cloud, Salesforce has announced the second installment in its series Read more