Here are the key insights from the 2023 Global Customer Engagement Review regarding the current landscape of customer engagement in the financial services sector, along with recommended strategies for driving activation, monetization, and retention among brands in this space. Financial Services and Customer Engagement.

Did you know that it takes an average of seven touchpoints for a customer to purchase what you’re selling? From the first time they see your product or brand somewhere until they hand over their hard-earned cash, there is a lot involved.

However, there is a huge difference between sales teams slowly nudging the customer towards the purchase and a sales rep aggressively badgering the customer to buy. What happens in these seven steps is something called sales engagement.

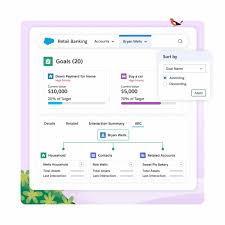

- Competitive Environment: Financial services brands must differentiate themselves in today’s competitive market by meeting heightened consumer expectations regarding privacy, value, trust, and personalized experiences. With economic volatility and the emergence of new payment methods, brands need to go beyond transactions and engage users throughout their financial journeys to foster long-term loyalty.

- Top Strategies: a. Cross-channel Engagement: Leveraging customers’ preferred messaging channels, particularly mobile channels, is crucial for activating, monetizing, and retaining financial services customers. Utilizing multiple channels significantly enhances outcomes, including increased sessions per user, purchases per user, and retention rates. b. Channel Combinations: Certain combinations of messaging channels yield maximum results. For instance, utilizing Content Cards, email, in-app messaging, and mobile push can lead to a fourfold increase in six-month retention compared to no messaging. c. Mobile Integration: Leading financial services brands prioritize mobile push notifications, recognizing their effectiveness in engaging customers. Integrating mobile into broader customer engagement strategies enhances overall performance and drives stronger results. d. Real-time Data Utilization: High-performing brands leverage real-time data streams to power segmentation, targeting, and analytics, enabling more relevant and responsive customer messaging and fostering deeper relationships.

- Key Priorities: a. Sending Helpful Messages: Financial services organizations aim to send more messages containing useful information and resources to keep customers engaged, particularly those facing financial challenges. b. Advanced Data Management: While ace brands excel in data management practices, including real-time segmentation and channel management, they also identify data management as a significant challenge for 2023, emphasizing the need for continuous improvement in this area.

For a comprehensive overview of global customer engagement trends in 2023, refer to the 2023 Global Customer Engagement Review, which includes insights from a survey of 1,500 VP+ marketing decision-makers across 14 global markets.

Sales engagement is a broad term that describes all the interactions that happen in the sales process between the sales development representatives and the customer. If you want to improve your sales team’s success, investing time and money in your sales engagement strategy is one of the best ways to achieve this.

Sales engagement touchpoints can be any of the following:

- Emails

- Phone calls with sales reps

- Face to face interactions

- Website visits

- Social media interactions

- SMS messages

There are many channels for sales engagement and leaving them out to chance is dangerous and hurting your sales efforts. In order to improve your sales efforts, you need to be intentional about how you communicate with customers and when.

This is why many sales teams carefully analyze each customer interaction and invest in sales engagement platforms.