Powering the Future of AI-Driven Data

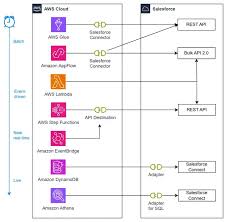

Salesforce’s Bold Move: Acquiring Informatica to Power the Future of AI-Driven Data San Francisco, CA — Salesforce’s acquisition of Informatica, a leader in enterprise cloud data management, marks a strategic leap in the race to turn messy, fragmented data into clean, AI-ready insights, Powering the Future of AI-Driven Data. By combining #1 AI CRM with best-in-class data governance, Salesforce is positioning itself to solve one of the biggest challenges in business today: harnessing data chaos for smarter decisions. Why This Deal Matters Salesforce’s Data Cloud was built to unify enterprise data in real time, fueling AI-driven workflows in sales, service, and beyond. But as data sprawls across systems, companies struggle with inconsistent records, identity resolution, and governance gaps—problems that cripple AI’s potential. Enter Informatica. With its Master Data Management (MDM), data quality, and metadata control, Informatica brings the missing structure to Salesforce’s ecosystem. The result? A true Customer 360 view, where every interaction—whether with a sales rep, service agent, or AI assistant—is powered by accurate, connected, and trustworthy data. The AI Data Advantage For AI to work at scale, it needs more than raw data—it needs context, transparency, and governance. The combined power of Salesforce and Informatica delivers: “Together, Salesforce and Informatica will create the most complete, agent-ready data platform in the industry,” said Marc Benioff, Salesforce Chair and CEO. “This is a game-changer for AI at scale.” What’s Next? A Unified Data Ecosystem Post-acquisition, Salesforce plans deep integrations across its platform: “Imagine an AI agent that doesn’t just see data but understands its full context—where it came from, how it changed, and whether it’s trustworthy,” said Steve Fisher, Salesforce CTO. “That’s the power of this combination.” The Bottom Line Salesforce isn’t just buying a data tool—it’s future-proofing its AI ambitions. With Informatica, businesses can finally:✔ Resolve duplicate records (no more “John Smith vs. Jon Smith” chaos).✔ Automate confidently (AI agents act on accurate, governed data).✔ Scale AI responsibly (with built-in compliance and audit trails). The deal, expected to close in early 2027, will be funded through cash and debt—and Salesforce expects it to boost margins and free cash flow within two years. For enterprises drowning in data disarray, this merger could be the lifeline they need. The age of AI-powered business runs on clean data—and Salesforce just secured its foundation. Want to prepare for the future of AI-driven data? Contact us to explore how this integration can transform your business. Like Related Posts Salesforce OEM AppExchange Expanding its reach beyond CRM, Salesforce.com has launched a new service called AppExchange OEM Edition, aimed at non-CRM service providers. Read more The Salesforce Story In Marc Benioff’s own words How did salesforce.com grow from a start up in a rented apartment into the world’s Read more Salesforce Jigsaw Salesforce.com, a prominent figure in cloud computing, has finalized a deal to acquire Jigsaw, a wiki-style business contact database, for Read more Service Cloud with AI-Driven Intelligence Salesforce Enhances Service Cloud with AI-Driven Intelligence Engine Data science and analytics are rapidly becoming standard features in enterprise applications, Read more