Understanding and Growing Your Monthly Recurring Revenue

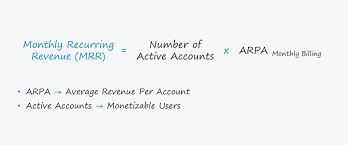

Understanding and Growing Your Monthly Recurring Revenue (MRR) Monthly Recurring Revenue (MRR) is a vital metric for subscription-based and managed services businesses. It indicates whether your business is growing or shrinking and is crucial for making strategic decisions. Understanding and Growing Your Monthly Recurring Revenue is a key to building, monitoring, and exploding your pipeline.