State Loan Processing Software by Salesforce

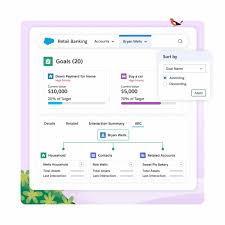

State Loan Processing Software: A Salesforce-Powered Solution Introduction In today’s fast-paced financial environment, efficient loan management is critical for lending institutions to succeed. Traditional loan processing methods are often inefficient, prone to errors, and unable to meet the demands of modern financial services. These outdated techniques lead to delays, compliance issues, and lost revenue. The answer lies in adopting advanced loan management software that leverages technology to streamline processes and enhance customer experiences. Current Challenges Many lenders continue to rely on outdated tools like spreadsheets and manual workflows, hindering productivity and increasing the potential for human error. A study by the National Association of Federal Credit Unions found that 60% of credit unions reported inefficiencies in their loan processes, negatively impacting member satisfaction. Key challenges faced by lending institutions include: Types of Loan Management Software To address these challenges, a variety of loan management software solutions have emerged, each designed to optimize specific aspects of the lending process. Loan Management Software Description: Automates essential loan processes like origination and payment processing. Main Features: Customer Relationship Management (CRM) Software Description: Platforms like Salesforce enable lenders to efficiently manage borrower relationships. Main Features: Compliance Management Software-State Loan Processing Software by Salesforce Description: Ensures lending practices adhere to state and federal regulations. Main Features: Analytics and Reporting Tools Description: Offers data-driven insights to guide strategic decision-making. Main Features: Integrated Payment Solutions Description: Streamlines payment processing across various channels. Main Features: Final Thoughts Adopting modern loan management software brings a host of advantages, including enhanced efficiency, improved compliance, and higher customer satisfaction. Platforms like Salesforce enable lenders to revolutionize their loan processing and management, making their operations more competitive in an evolving market. For lenders seeking to transform their approach to loan management, innovative solutions like Salesforce and Tectonic offer a path to operational excellence and business growth. Like Related Posts Salesforce OEM AppExchange Expanding its reach beyond CRM, Salesforce.com has launched a new service called AppExchange OEM Edition, aimed at non-CRM service providers. Read more The Salesforce Story In Marc Benioff’s own words How did salesforce.com grow from a start up in a rented apartment into the world’s Read more Salesforce Jigsaw Salesforce.com, a prominent figure in cloud computing, has finalized a deal to acquire Jigsaw, a wiki-style business contact database, for Read more Service Cloud with AI-Driven Intelligence Salesforce Enhances Service Cloud with AI-Driven Intelligence Engine Data science and analytics are rapidly becoming standard features in enterprise applications, Read more