AgentForce for Financial Services

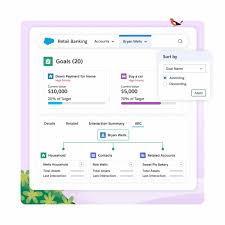

Salesforce Revolutionizes Financial Services with AI-Powered Agentforce Platform AI Agents Take on Banking, Insurance, and Advisory Roles Salesforce has launched a suite of prebuilt AI agent templates designed to automate critical functions across financial services—from loan processing to insurance underwriting and wealth management. Embedded within Financial Services Cloud, these AI assistants aim to reduce administrative burdens, enhance customer experiences, and boost operational efficiency for banks, insurers, and investment firms. Key Features of Agentforce for Financial Services ✔ Prebuilt AI agents for loan officers, financial advisors, and insurance agents✔ 24/7 automated customer service (balance inquiries, claims processing, policy quotes)✔ Meeting intelligence (automated note-taking, follow-ups, and data-driven insights)✔ Regulatory compliance baked into every AI action✔ Seamless integration with core banking and CRM systems How AI Agents Transform Financial Workflows 1. Financial Advisors: Smarter, Faster Client Interactions 2. Banking & Insurance: Instant, Accurate Customer Service 3. Digital Loan Officers: Faster Approvals, Fewer Delays Why Financial Firms Need Specialized AI Agents Traditional customer service struggles with:❌ Long hold times❌ Repetitive data entry❌ Inconsistent compliance checks Agentforce AI solves these pain points by:✅ Reducing manual work (80%+ of routine tasks automated)✅ Improving accuracy (data-driven decisions, no human errors)✅ Ensuring compliance (built-in regulatory safeguards) Real-World Impact: “Agentforce has already transformed our service operations. The speed of deployment and immediate productivity gains have us exploring AI for claims and procurement next.”— Matt Brasch, VP of Digital Operations, Cumberland Mutual LLC The Future of AI in Finance Salesforce emphasizes that AI won’t replace human experts—it will empower them. By offloading repetitive tasks, financial professionals can focus on:✔ High-value client relationships✔ Complex decision-making✔ Strategic business growth Coming Next: Final Takeaway Salesforce’s Agentforce for Financial Services marks a major leap in AI-driven banking and insurance automation. Firms adopting this technology can expect:🔹 Faster customer service🔹 Higher advisor productivity🔹 Stronger compliance🔹 Increased revenue per employee Ready to deploy AI agents in your financial workflows? Contact Tectonic. Like Related Posts Salesforce OEM AppExchange Expanding its reach beyond CRM, Salesforce.com has launched a new service called AppExchange OEM Edition, aimed at non-CRM service providers. Read more The Salesforce Story In Marc Benioff’s own words How did salesforce.com grow from a start up in a rented apartment into the world’s Read more Salesforce Jigsaw Salesforce.com, a prominent figure in cloud computing, has finalized a deal to acquire Jigsaw, a wiki-style business contact database, for Read more Service Cloud with AI-Driven Intelligence Salesforce Enhances Service Cloud with AI-Driven Intelligence Engine Data science and analytics are rapidly becoming standard features in enterprise applications, Read more