A shorter shopping season, the rise of Chinese shopping apps, and value-conscious consumers are expected to result in modest growth this holiday season.

According to Salesforce’s 2024 holiday shopping forecast, U.S. holiday sales (Nov. 1 – Dec. 31) are projected to grow 2% year-over-year, reaching $277 billion. Global sales are also predicted to increase by 2%, totaling .19 trillion. This reflects softer growth compared to 2023, when global holiday sales rose by 3%.

Challenges Ahead

Salesforce warns that the 2024 holiday season may be difficult for retailers, with consumers having less spending power, a shortened 26-day shopping window between Thanksgiving and Christmas, and 43% of shoppers carrying more debt than last year. Additionally, 47% of surveyed shoppers plan to spend the same as in 2023, while 40% intend to spend less.

New data from Salesforce’s Shopping Index shows that two-thirds of global consumers say price will dictate their shopping choices, while less than a third will prioritize product quality.

Impact of Chinese Shopping Apps

Salesforce predicts that 21% of holiday purchases will come from Chinese apps like Temu, Shein, AliExpress, and TikTok, with 35% of consumers reporting increased use of these apps. TikTok, in particular, saw a 24% increase in purchases since April 2024, highlighting the growing influence of Chinese platforms on holiday shopping.

Retail Strategies

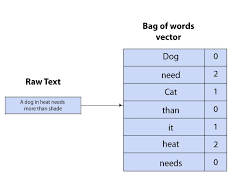

To navigate the competitive landscape, Salesforce recommends retailers use strategic discounts and AI-powered tools to improve efficiency, enhance customer relationships, and boost profit margins.

“This season will be competitive and focused on pricing strategies,” said Caila Schwartz, Salesforce’s director of strategy and consumer insights. “Leveraging AI and customer data is essential to guide marketing campaigns and holiday promotions.”

Key Findings

- Two-thirds of shoppers are delaying major purchases until Cyber Week, believing it offers the best deals.

- Global discounts will peak at an average of 28% during Cyber Week, with U.S. discounts reaching up to 30%.

- 18% of global holiday orders will be influenced by AI, representing $201 billion in sales.

- Over half of surveyed shoppers are interested in using AI for gift inspiration, price comparisons, and budgeting.

- Buy online, pick up in-store (BOPIS) will account for 33% of global online orders during the week leading up to Christmas and Boxing Week, driven by the shorter shopping season.

Salesforce’s insights are based on data from 1.5 billion global shoppers across 64 countries, focusing on 12 key markets, including the U.S., Canada, and U.K.