Salesforce AI Tools for Healthcare

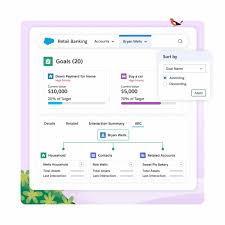

Salesforce to Launch Pre-Built AI Tools for Healthcare in October Salesforce is introducing a new library of out-of-the-box AI tools specifically designed for healthcare operations, available through its Health Cloud. These generative AI features aim to streamline time-consuming tasks by integrating directly into clinician workflows, enhancing both the quality and efficiency of patient care. Key Features and Benefits Part of Salesforce’s broader initiative to address operational challenges across 15 industries, these healthcare-specific AI tools are embedded in each of its industry clouds. The Einstein Copilot, for example, will allow healthcare providers to generate patient summaries in natural language, leveraging new data management capabilities. This could enable care coordinators to view comprehensive patient summaries—such as care plans, prescriptions, and prior authorizations—before appointments. According to Salesforce, these AI-driven services, powered by Einstein prompts, are integrated within Health Cloud’s member accounts, simplifying administrative tasks like sending referrals and booking appointments. Data privacy and security remain a priority, with Einstein’s data masking and zero data retention layer ensuring patient information is protected. Beyond patient care, the new AI features will support business operations, including verifying insurance coverage, determining out-of-pocket costs, and ensuring eligibility—all designed to reduce administrative burdens and improve operational efficiency. Why It Matters Healthcare organizations often lack the resources to build and train their own AI models, a process that can cost upwards of 0 million. Salesforce’s pre-built AI capabilities provide an accessible solution, allowing organizations of all sizes to adopt AI tools tailored to their specific needs. By automating administrative processes, healthcare providers can focus more on patient care, with faster approvals and fewer manual tasks. Salesforce is positioning these tools to help organizations streamline workflows, reduce inefficiencies, and ultimately improve the patient experience. The features will be generally available in October, with pricing based on specific implementations. Industry Impact and Larger Trend The release of these healthcare-specific AI tools is part of Salesforce’s broader push into industry-specific AI. In March, Salesforce launched the Einstein AI Copilot within its Einstein 1 Platform, designed to leverage healthcare organizations’ unique data within its Health Data Cloud. New capabilities, such as patient services and benefits verification, aim to reduce platform switching, enabling faster approvals and supporting clinicians in real-time patient record updates. Salesforce’s investment in industry-specific AI comes at a time when many healthcare organizations are grappling with the rising costs of technology and labor. At the HIMSS AI in Healthcare Forum in Boston, leaders echoed the challenges of managing expansive technology footprints while balancing the need for AI-driven transformation. Operational workflows, particularly back-office processes, offer a low-risk area for AI deployment, as noted by Lee Schwamm, chief digital health officer at Yale New Haven Health System. On the Record “Organizations of every size and budget can now easily get started with practical AI tools that were purposefully designed to solve their unique challenges,” said Jeff Amann, executive vice president and general manager of Salesforce Industries. Salesforce’s new AI use case library, featuring more than 100 AI capabilities embedded across 15 industry clouds, underscores the company’s commitment to developing industry-specific solutions. For healthcare, these tools include automated patient matching for clinical trials, AI-generated prescriptions, and pre-visit summaries—helping organizations accelerate time to care and improve clinical outcomes. In addition, a new auto-matching tool for life sciences will assist in identifying eligible clinical trial participants, using both structured and unstructured data to reduce assessment time. These features allow healthcare CIOs to easily deploy AI capabilities designed to address their organization’s unique needs. Looking Ahead Salesforce’s latest AI tools for healthcare represent a significant step in the company’s strategy to bring industry-specific AI to market, with healthcare, life sciences, financial services, and retail among its top priorities. By offering pre-built, customizable solutions, Salesforce is making AI accessible to a broader range of organizations, enabling them to deliver value quickly while navigating the complexities of modern healthcare operations. Like1 Related Posts Salesforce OEM AppExchange Expanding its reach beyond CRM, Salesforce.com has launched a new service called AppExchange OEM Edition, aimed at non-CRM service providers. Read more The Salesforce Story In Marc Benioff’s own words How did salesforce.com grow from a start up in a rented apartment into the world’s Read more Salesforce Jigsaw Salesforce.com, a prominent figure in cloud computing, has finalized a deal to acquire Jigsaw, a wiki-style business contact database, for Read more Service Cloud with AI-Driven Intelligence Salesforce Enhances Service Cloud with AI-Driven Intelligence Engine Data science and analytics are rapidly becoming standard features in enterprise applications, Read more