Unified Knowledge for Service Agents

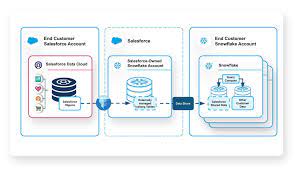

Salesforce has introduced a new intelligence source for service agents called Unified Knowledge. This solution aggregates information from third-party sources and integrates it into Salesforce, enhancing the customer data available in Data Cloud. Unified Knowledge Overview Enhanced Service with Unified Knowledge Unified Knowledge aggregates data from sources like SharePoint, Confluence, Google Drive, and brand websites, making it accessible within Salesforce Service Cloud. While Service Cloud has primarily utilized data from Data Cloud via Einstein for Service to assist service agents, Unified Knowledge expands this by including additional third-party information. Broader Integration Across Salesforce Although Service Cloud is a primary focus, Unified Knowledge will also integrate with Salesforce Field Service, Sales Cloud, Health Cloud, and Financial Services Cloud. This solution was developed in partnership with Zoomin Software. Technical Approach and Future Plans The initial version of Unified Knowledge does not utilize Data Cloud. Instead, it stores third-party knowledge in the KnowledgeArticle object on Core and uses Zoomin for integration. Salesforce plans to eventually transition this solution to Data Cloud for both storage and integration. This transition involves multiple dependencies and significant refactoring of the Knowledge product. For now, the current approach allows for quicker market entry. Once moved to Data Cloud, customers will need Data Cloud credits to use Unified Knowledge. Response by email from Salesforce: “The beta version of Unified Knowledge does not leverage Data Cloud. The third-party Knowledge is stored on Core in the KnowledgeArticle object, and Salesforce uses ZoomIn to integrate with third-party systems. Salesforce’s long-term vision is to move to Data Cloud — initially for the storage of third-party knowledge, and eventually for the connector/integration piece as well. This involves multiple dependencies on Data Cloud however and significant refactoring of the Knowledge product, so in order to get this solution to market more quickly, this initial version is built on Core. Once we move Unified Knowledge to Data Cloud, customers will have to purchase Data Cloud credits to use the product.” Benefits and Features of Unified Knowledge Unified Knowledge enhances the information available to service agents, potentially leading to better service experiences. Its generative AI capabilities include: By expanding the data available to service agents, Unified Knowledge aims to improve service quality and efficiency. Like Related Posts Salesforce OEM AppExchange Expanding its reach beyond CRM, Salesforce.com has launched a new service called AppExchange OEM Edition, aimed at non-CRM service providers. Read more The Salesforce Story In Marc Benioff’s own words How did salesforce.com grow from a start up in a rented apartment into the world’s Read more Salesforce Jigsaw Salesforce.com, a prominent figure in cloud computing, has finalized a deal to acquire Jigsaw, a wiki-style business contact database, for Read more Service Cloud with AI-Driven Intelligence Salesforce Enhances Service Cloud with AI-Driven Intelligence Engine Data science and analytics are rapidly becoming standard features in enterprise applications, Read more