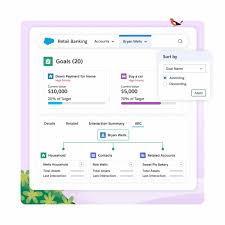

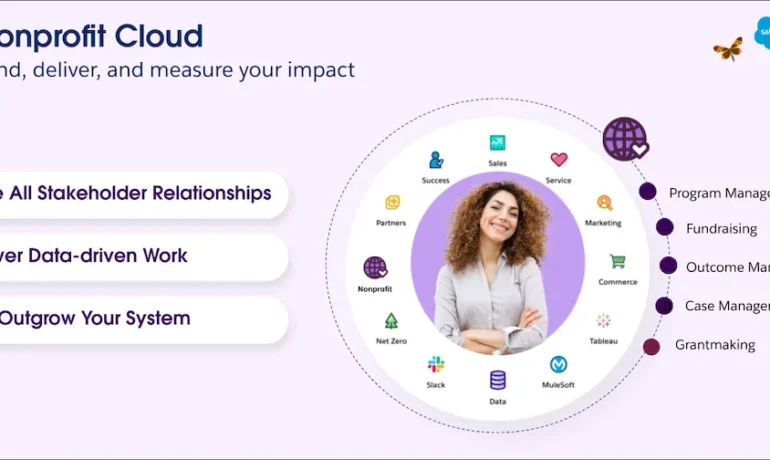

Centralized Data Storage & Management Salesforce Mortgage CRM consolidates all your mortgage data into a single platform, offering a unified view of client information, loan details, and transaction history. This eliminates the confusion of scattered data, ensuring brokers have quick access to crucial information. For instance, if a client calls with questions about their loan, brokers can immediately retrieve accurate details, enhancing trust and improving the client experience. Accurate Loan Forecasting With AI-driven data analytics, Salesforce provides actionable insights into future loan opportunities, potential risks, and projected income. By analyzing historical data, brokers can predict client behavior, such as the likelihood of refinancing. This proactive approach allows brokers to deliver tailored offers, increasing conversions and client satisfaction. Seamless Collaboration & Secure Data Sharing Effective communication within an organization is essential, and Salesforce Mortgage CRM excels at connecting team members across locations and devices. Features like document management ensure efficient workflows through version control, rights management, and advanced search capabilities. Brokers can also share select records or documents securely with external stakeholders by granting limited access, ensuring confidentiality while streamlining the lending process. Top-Notch Security Salesforce Mortgage CRM prioritizes data security with multi-level protocols, including multi-factor authentication, data encryption, 24/7 monitoring, and an advanced Trust Layer. These features ensure that sensitive client information, such as financial and personal data, is safeguarded, fostering confidence among potential borrowers. Personalized Client Interactions Every client’s journey is unique, and Salesforce empowers brokers to deliver personalized experiences. For example, if a client’s fixed-rate term is nearing its end, Salesforce can automate outreach with refinancing options. This level of personalization improves client satisfaction and strengthens retention strategies. In-Depth Analytics and Visualization Salesforce offers robust analytics tools to provide mortgage professionals with insights into client behavior, market trends, operational performance, and risk factors. Interactive dashboards and customizable reports enable brokers to visualize metrics like loan-to-value ratios, debt-to-income ratios, and delinquency rates. These insights help streamline operations, improve profitability, and mitigate risks. Automation and AI-Powered Assistance Salesforce integrates cutting-edge AI tools to automate routine tasks, segment clients, and deliver tailored recommendations. Brokers can use these tools to identify refinancing opportunities, streamline workflows, and increase efficiency. While advanced AI features may require premium subscriptions, Salesforce also provides no-code automation capabilities. Tools like Salesforce Flow allow users to create automated workflows for tasks such as data entry, follow-ups, and approvals. For complex workflows, Flow Orchestrator enables brokers to coordinate multi-step processes seamlessly. These automation features eliminate manual tasks, freeing brokers to focus on high-value activities. Streamline Your Lending Process with Salesforce Mortgage CRM Whether you’re looking to centralize your data, enhance client relationships, or improve operational efficiency, Salesforce Mortgage CRM offers a comprehensive solution. Its combination of AI, analytics, and automation ensures that your team can work smarter, not harder. Ready to transform your mortgage business? Let Salesforce help you achieve greater efficiency and client satisfaction today. Unlock the Full Potential of Mortgage Lending with Salesforce Mortgage CRM Automation Without AI Salesforce Mortgage CRM streamlines repetitive tasks through its no-code automation capabilities, removing the need for AI. Salesforce Flow allows brokers to create automated workflows triggered by specific events, such as follow-up tasks, reminders, or status updates. For more intricate workflows, Flow Orchestrator provides seamless coordination for multi-step processes, including approvals, ensuring a smooth lending experience. Whether sending monthly statements or routing documents between stakeholders in the approval process, Salesforce Mortgage CRM automates these tasks based on your predefined rules. For enterprises, Financial Services Cloud (FSC) offers pre-built templates to manage mortgage applications. For SMBs, building tailored flows from scratch can be a more efficient and cost-effective solution, offering greater customization without overpaying for unused FSC features. An excellent example of Salesforce’s versatility is integrating scheduling tools like Calendly with borrower portals built in Experience Cloud. These portals allow clients to book appointments while considering time zone differences and send automated reminders, ensuring seamless borrower engagement. Platform Customization and Scalability Salesforce is an agile platform that adapts to your business needs. Need custom fields for underwriting criteria? A new object to track loan pipeline opportunities? Or automated workflows to manage approvals? Salesforce’s intuitive point-and-click configuration tools empower you to customize your system without complex coding, making it a perfect fit for businesses of any size. Seamless Integration with Third-Party Tools Salesforce’s vast ecosystem, powered by the AppExchange, offers over 7,000 add-ons to enhance your CRM’s functionality. From digital signature solutions to mortgage rate comparison tools, these integrations eliminate the need for extensive custom development. If your unique needs aren’t met by existing options, Salesforce’s certified AppExchange partners can help create tailored solutions. Salesforce Products Tailored for Mortgage Lending Firms 1. Financial Services Cloud (FSC) FSC is purpose-built for the financial services industry, including mortgage lending. It provides a 360-degree view of clients, integrating their financial holdings, activities, and loan details. With FSC, lenders can offer personalized recommendations, streamline the underwriting process, and stay compliant with industry regulations using built-in risk management tools. 2. Marketing Cloud Account Engagement (Pardot) Pardot empowers lenders to engage potential borrowers effectively. For example, a mortgage firm targeting first-time homebuyers can use Pardot to create automated, personalized email campaigns, nurturing leads with tailored content about loans, interest rates, and homebuying tips.Real-time insights and Einstein-powered predictive lead scoring help mortgage professionals prioritize high-value leads and track engagement through detailed campaign performance metrics, such as Multi-Touch Attribution Reports. 3. Experience Cloud For mortgage firms looking to provide a self-service option, Experience Cloud allows for building custom portals and websites. Borrowers can use these portals to upload documents, track application statuses, and access loan details. The drag-and-drop design tools and pre-built templates make it easy to create branded, user-friendly interfaces without requiring extensive coding. 4. Service Cloud Customer service is critical in the mortgage process, and Salesforce Service Cloud enhances this experience with omnichannel support across email, chat, and phone. Borrowers can quickly get answers to questions about their applications, while automation retrieves and shares relevant data instantly. This improves response times, reduces manual effort, and ensures borrowers receive