Integrating Revenue Management with Salesforce Revenue Cloud

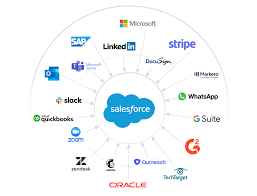

If your organization utilizes both Revenue Management and Salesforce Revenue Cloud Integration, you can seamlessly integrate them using the Revenue Cloud Connector feature available in Feature Console. Enabling this feature configures your org with a standardized integration, allowing Revenue Management to effectively recognize revenue and costs against Salesforce orders.

Key Integration Capabilities

By enabling the Revenue Cloud Connector feature, you benefit from:

- Standard Integration: Your organization gains a standard integration setup that facilitates the use of Revenue Management for revenue recognition processes.

- Recognition Settings and Templates: Specific recognition settings and templates are established, enabling direct recognition against your source objects. For instance:

- ASC 605 Compliance: Recognition directly against source objects like Order Items.

- ASC 606 and IFRS 15 Compliance: Recognition using revenue contracts, facilitating compliance with these standards.

Hierarchical Structure of Recognition Settings

The integration creates recognition settings records for Salesforce objects organized in the following hierarchical structure:

- Group: Represents the primary grouping level.

- Primary Object: Initial level, such as Order. Orders must have a status of Activated for eligible records at subsequent levels to be considered for recognition.

Level 2 Objects:

- Order Item: Includes order products eligible for recognition based on their Charge Type criteria.

Level 3 Objects:

- Invoice: Invoices must have a status of Posted and be related to an Activated order for eligible records at Level 3 or Level 4 to be recognized.

- Invoice Line: Includes invoice lines eligible for recognition based on Charge Type criteria.

Level 4 Objects:

- Credit Note: Credit notes must have a status of Posted and have the Source Invoice field populated for eligible records at this level to be included for recognition.

- Credit Note Line: Includes credit note lines eligible for recognition based on the credit note’s status and populated Source Invoice field.

Recognition Transactions

The resulting recognition transactions encompass transaction lines generated from:

- Order products

- Invoice lines

- Credit note lines

- Usage summaries (if utilized)

Additional Considerations

- Field Adjustments: The logic determining whether a record is included for recognition resides in the “Include in Revenue Recognition” field on relevant objects, which is unmanaged for flexibility in logic adjustments.

- Legal Entity Requirement: The integration introduces a Legal Entity field to the Order object. Ensuring this field is populated is crucial for accurately grouping transaction lines by legal entity, complementing the Legal Entity field on order products required by Salesforce.

Revenue Contracts for Revenue Cloud

For organizations creating revenue contracts for Salesforce orders, enabling the “Revenue Contracts for Revenue Cloud” feature is recommended. This feature streamlines the creation of revenue contracts via engagements linked to orders:

- Engagement Creation: Activating an order triggers engagement creation.

- Revenue Contract Creation: A revenue contract is then generated for the engagement, encompassing performance obligations from order products, invoice lines, credit note lines, and usage summaries aligned with applicable templates.

For comprehensive details regarding fields, recognition settings, and templates established upon feature activation, refer to “Metadata Changes when Enabling Revenue Cloud Connector.” Instructions for enabling the feature are available under “Enabling Revenue Cloud Connector.”

By leveraging these integrative features, organizations enhance their ability to manage revenue recognition efficiently and maintain compliance with regulatory standards.