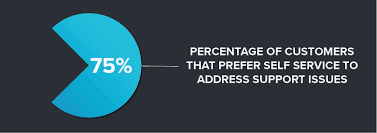

Leveraging AI to Alleviate the Documentation Burden in Nursing As the nursing profession grapples with increasing burnout, researchers are investigating the potential of large language models to streamline clinical documentation and care planning. Nurses play an essential role in delivering high-quality care and improving patient outcomes, but the profession is under significant strain due to shortages and burnout. AI Assisting Nursing could lessoning burnout while improving communication. What role could Salesforce play? The American Nurses Association (ANA) emphasizes that to maximize nurses’ potential, healthcare organizations must prioritize maintaining an adequate workforce, fostering healthy work environments, and supporting policies that back nurses. The COVID-19 pandemic has exacerbated existing challenges, including increased healthcare demand, insufficient workforce support, and a wave of retirements outpacing the influx of new nurses. Tectonic has nearly two decades of experience providing IT solutions for the health care industry. Salesforce, as a leader in the field of artificial intelligence, is a top tool for health care IT. AI Assisting Nursing In response to these growing demands, some experts argue that AI technologies could help alleviate some of the burden, particularly in areaTes like clinical documentation and administrative tasks. In a recent study published in the Journal of the American Medical Informatics Association, Dr. Fabiana Dos Santos, a post-doctoral research scientist at Columbia University School of Nursing, led a team to explore how a ChatGPT-based framework could assist in generating care plan suggestions for a lung cancer patient. In an interview with Healthtech Analytics, Dr. Santos discussed the potential and challenges of using AI chatbots in nursing. Challenges in Nursing Care Plan Documentation Creating care plans is vital for ensuring patients receive timely, adequate care tailored to their needs. Nurses are central to this process, yet they face significant obstacles when documenting care plans. AI Assisting Nursing and Salesforce as a customer relationship solution addresses those challenges. “Nurses are on the front line of care and spend a considerable amount of time interacting closely with patients, contributing valuable clinical assessments to electronic health records (EHRs),” Dr. Santos explained. “However, many documentation systems are cumbersome, leading to a documentation burden where nurses spend much of their workday interacting with EHRs. This can result in cognitive burden, stress, frustration, and disruptions to direct patient care.” The American Association of Critical-Care Nurses (AACN) highlights that electronic documentation is a significant burden, consuming an average of 40% of a nurse’s shift. Time spent on documentation inversely correlates with time spent on patient care, leading to increased burnout, cognitive load, and decreased job satisfaction. These factors, in turn, contribute to patient-related issues such as a higher risk of medical errors and hospital-acquired infections, which lower patient satisfaction. When combined with the heavy workloads nurses already manage, inefficient documentation tools can make care planning even more challenging. AI Assisting Nursing and Care Plans “The demands of direct patient care and managing multiple administrative tasks simultaneously limit nurses’ time to develop individualized care plans,” Dr. Santos continued. “The non-user-friendly interfaces of many EHR systems exacerbate this challenge, making it difficult to capture all aspects of a patient’s condition, including physical, psychological, social, cultural, and spiritual dimensions.” To address these challenges, Dr. Santos and her team explored the potential of ChatGPT to improve clinical documentation. “These negative impacts on a nurse’s workday underscore the urgency of improving EHR documentation systems to reduce these issues,” she noted. “AI tools, if well designed, can improve the process of developing individualized care plans and reduce the burden of EHR-related documentation.” The Promises and Pitfalls of AI Developing care plans requires nurses to draw from their expertise to address issues like symptom management and comfort care, especially for patients with complex needs. Dr. Santos emphasized that advanced technologies, such as generative AI (GenAI), could streamline this process by enhancing documentation workflows and assisting with administrative tasks. AI tools can rapidly process large amounts of data and generate care plans more quickly than traditional methods, potentially allowing nurses to spend more time on direct and holistic patient care. However, Dr. Santos stressed the importance of carefully validating AI models, ensuring that nurses’ clinical judgment and expertise play a central role in evaluating AI-generated care plans. “New technologies can help nurses improve documentation, leading to better descriptions of patient conditions, more accurate capture of care processes, and ultimately, improved patient outcomes,” she said. “This presents an important opportunity to use novel generative AI solutions to reduce nurses’ workload and act as a supportive documentation tool.” Despite the promise of AI as a support tool, Dr. Santos cautioned that chatbots require further development to be effectively implemented in nursing care plans. AI-generated outputs can contain inaccuracies or irrelevant information, necessitating careful review and validation by nurses. Additionally, AI tools may lack the nuanced understanding of a patient’s unique needs, which only a nurse can provide through personal, empathetic interactions, such as interpreting specific cultural or spiritual needs. Despite these challenges, large language models (LLMs) and other GenAI tools are generating significant interest in the healthcare industry. They are expected to be deployed in various applications, including EHR workflows and nursing efficiency. Dr. Santos’ research contributes to this growing field. To conduct the study, the researchers developed and validated a method for structuring ChatGPT prompts—guidelines that the LLM uses to generate responses—that could produce high-quality nursing care plans. The approach involved providing detailed patient information and specific questions to consider when creating an appropriate care plan. The research team refined the Patient’s Needs Framework over ten rounds using 22 diverse hypothetical patient cases, ensuring that the ChatGPT-generated plans were consistent and aligned with typical nursing care plans. “Our findings revealed that ChatGPT could prioritize critical aspects of care, such as oxygenation, infection prevention, fall risk, and emotional support, while also providing thorough explanations for each suggested intervention, making it a valuable tool for nurses,” Dr. Santos indicated. The Future of AI in Nursing While the study focused on care plans for lung cancer, Dr. Santos emphasized that this research is just the beginning of