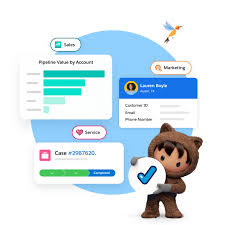

In banking, Customer 360 is a strategy and technology that provides a comprehensive, unified view of each customer’s data from various sources, like core banking systems, CRM, and marketing platforms. This centralized view enables banks to understand customer behavior, predict needs, and deliver personalized experiences, ultimately improving customer relationships and business outcomes.

Key aspects of Customer 360 in banking:

- Unified View: Customer 360 brings together all customer data into one place, creating a single source of truth.

- Data Integration: It integrates data from various banking systems, including core banking, CRM, and marketing platforms.

- Customer Insights: It enables banks to understand customer behavior, predict needs, and identify opportunities for personalized interactions.

- Personalized Experiences: Customer 360 allows banks to tailor products, services, and communications to individual customer preferences and needs.

- Improved Customer Relationships: By understanding customers better, banks can foster stronger, more loyal relationships.

Benefits of Customer 360 in banking:

- Enhanced Customer Experience: Personalized interactions lead to increased customer satisfaction and loyalty.

- Improved Sales and Marketing: Targeted campaigns and offers increase sales and marketing effectiveness.

- Reduced Churn: Understanding customer behavior allows banks to identify at-risk customers and implement retention strategies.

- Increased Operational Efficiency: A unified view of customer data simplifies processes and reduces the need for manual data entry.

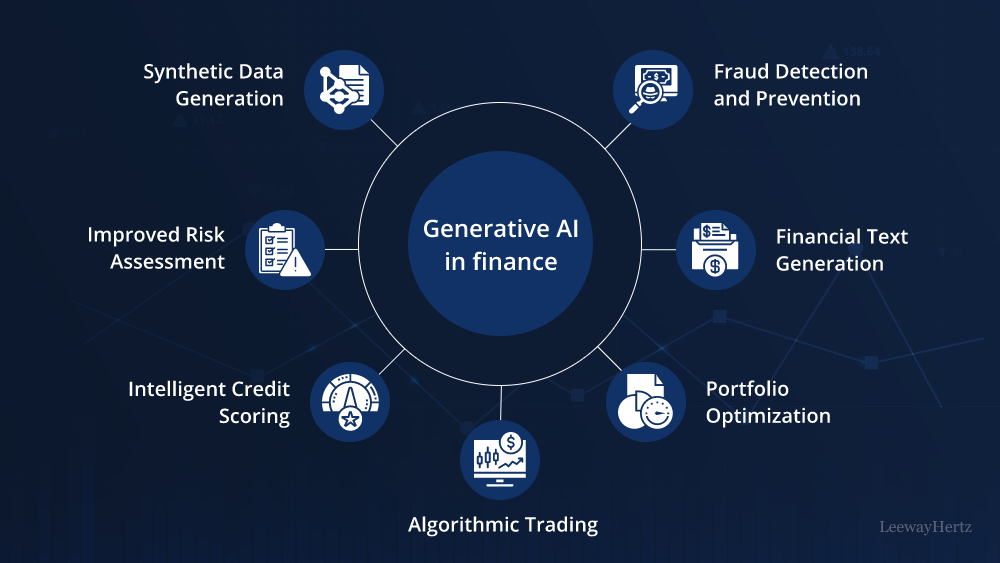

- Fraud Prevention: Customer 360 can help identify and prevent fraudulent activities.