San Francisco, CA – [May 27, 2025] – Salesforce (NYSE: CRM) has announced its acquisition of AI-powered cloud data management leader Informatica (NYSE: INFA) in an all-cash $8 billion deal, significantly expanding its enterprise data capabilities in the AI era.

Key Deal Terms

- Price per share: **25∗∗(1125∗∗(1122.55)

- Total enterprise value: ~**8B∗∗(including8B∗∗(including1.9B in net debt)

- Expected close: Early in Salesforce’s fiscal 2027 (subject to regulatory approvals)

- Market reaction:

- Informatica shares ↑ 5.7% in pre-market trading

- Salesforce shares edge higher ahead of earnings

Strategic Rationale

The acquisition accelerates Salesforce’s AI and data integration strategy, giving it:

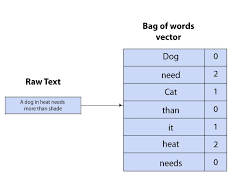

✔ Enterprise-grade cloud data management for structured/unstructured data

✔ Enhanced AI readiness with Informatica’s metadata intelligence

✔ Stronger vertical play in healthcare, financial services, and public sector

“This union will help businesses unlock the full potential of their data in the AI revolution,” said Informatica CEO Amit Walia.

From Private to Public – And Now to Salesforce

- 2015: Taken private by Permira & CPPIB ($5.3B deal)

- 2021: Returned to public markets via IPO

- 2024-25: Emerged as a key Salesforce M&A target

What’s Next?

Salesforce plans to rapidly integrate Informatica’s tech into its Customer 360 and Einstein AI platforms, with CFO Robin Washington highlighting near-term synergies in regulated industries.

The deal marks Salesforce’s return to large-scale M&A after activist investor pressure to curb spending. Analysts will be watching for integration risks and competitive responses from Microsoft, Oracle, and Snowflake.