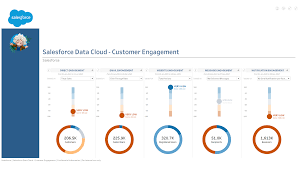

In the digital era, banks face a significant challenge: obtaining a clear, reliable, and accurate understanding of their customers amidst a vast amount of fragmented data spread across different systems. Tracking Money Flows with Data Cloud.

Despite the abundance of data, it often fails to provide a complete or accurate narrative. Simple questions like “Did a customer’s funds remain within the bank or exit entirely?” can be surprisingly challenging to answer due to this fragmented data.

This disjointed view of customer behavior obstructs banks from leveraging valuable data to make informed decisions and enhance client engagement.

Data Cloud and Data Strategy

The solution lies not just in the data itself but in developing a robust strategy to consolidate customer data and make it actionable. By breaking down data silos and constructing comprehensive customer profiles, banks can unlock the true potential of their information. This leads to a deeper comprehension of their clients, enabling them to make intelligent decisions that drive engagement, predict customer needs, and manage attrition risks effectively.

In today’s intricate economic landscape, this data-driven approach isn’t merely advantageous—it’s essential for banks to stay competitive and achieve sustained success.

Tracking Money and Money Flows with Data Cloud

Consider the case of William to illustrate the impact of data analytics. William, a sophisticated investor, continuously shifted his funds seeking the best returns. This presented a challenge for his bank, whose legacy systems were ill-equipped to track his dynamic financial activities effectively.

The bank’s inability to follow William’s money hindered marketing and attrition management efforts. They needed to understand if funds were truly leaving the institution or just relocating within its ecosystem.

The introduction of Data Cloud transformed the bank’s capabilities. By consolidating disparate data sources, they gained real-time insights into William’s financial activities, allowing them to understand his relationship with the bank better and make more reliable attrition predictions.

Armed with this knowledge, the bank personalized their approach to William, showcasing tailored offerings aligned with his financial objectives. This personalized engagement transformed their relationship from transactional to collaborative, reducing attrition risk and maximizing mutual benefit.

William’s case became a model for the bank, demonstrating the power of unifying data silos to understand customers’ financial behavior comprehensively.

In today’s financial environment, overcoming fragmented data is paramount. Data Cloud offers a winning solution:

- Unify Customer Data: Gain a holistic view of customers’ financial activities across internal and external sources.

- Identify Opportunities: Serve high-value customers better by identifying their needs and preferences.

- Strengthen Relationships: Build trust and loyalty by demonstrating an in-depth understanding of customers’ financial goals.

- Mitigate Risk and Enhance Security: Proactively detect and prevent fraudulent activities, ensuring compliance and safeguarding assets.

Harnessing the abundance of data is crucial. By leveraging tools like Data Cloud, banks can unravel the mysteries of customer behavior and optimize their operations effectively.