Focused Marketing for Financial Services Firms: The Power of Account-Based Marketing (ABM)

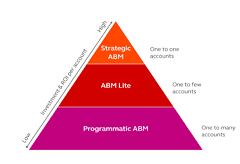

Financial services firms often find that a broad-based marketing approach is less effective than Account-Based Marketing (ABM). By concentrating efforts on high-value accounts, ABM enables financial sector businesses to accelerate growth and cultivate long-term customers.

ABM: A Precision Tool for Financial Growth

Key Takeaways:

- Activity-Based Management (ABM): This approach evaluates each business aspect to identify strengths and weaknesses, guiding management to improve or eliminate unprofitable areas.

Enhance Your Marketing with ABM Strategies

- Timely Communications: Engage clients with up-to-date information.

- Daily Content Updates: Keep your audience curious and informed.

- Lead-Optimized Pages: Drive actions with effective landing pages.

- Flexible Marketing Automation: Save time while maintaining engagement.

- AI-Powered Client Insights: Use artificial intelligence to uncover client interests and recommend next steps.

- Automated Communications: Generate leads and schedule meetings efficiently.

- Customizable Forms: Collect the precise data you need with tailored forms.

- Real-Time Reporting: Identify engaged prospects instantly.

Leveraging Digital Marketing in Financial Services

Digital marketing, including SEO, social media, and email campaigns, enables financial services to reach broader audiences efficiently. Big data analytics provide deep insights into customer behavior, enhancing targeted marketing efforts.

The Four P’s of Marketing in Financial Services

The marketing mix in financial services involves:

- Product: Developing innovative financial products.

- Price: Competitive and transparent pricing strategies.

- Place: Accessibility through digital and physical channels.

- Promotion: Strategic investment in marketing efforts.

Financial Services Marketing: Key Tectonic Insights

Financial services firms spend significantly on acquiring potential customers but less on converting them. For every $92 spent on lead acquisition, only $1 is invested in conversion. This disparity points to a need for more efficient marketing strategies that bridge this gap, focusing on both acquisition and retention.

The Importance of Financial Services Marketing

With increased competition and shifting customer expectations, financial service providers can no longer rely on passive approaches. They must actively engage their target audience, navigate regulatory challenges, and embrace digital transformation to stay competitive.

Navigating Regulatory Constraints

Financial services marketing must comply with various regulations:

- Truth in Advertising Act: Ensures advertisements are not misleading.

- Truth in Savings Act: Mandates transparency in financial products.

- Fair Lending Laws: Prohibits discriminatory lending practices.

Optimizing Marketing ROI and Compliance

Financial service providers must balance effective marketing strategies with regulatory compliance. This requires:

- Digital-First Strategies: Engaging digital-savvy consumers through targeted digital marketing.

- Omnichannel Campaigns: Providing integrated experiences across various platforms.

- Content Marketing: Educating and empowering customers with valuable information.

- Personalized Touchpoints: Creating individualized experiences based on customer data.

Leveraging Technology for Marketing Efficiency

Technology plays a crucial role in modern financial services marketing:

- Automation: Streamlining tasks like lead nurturing and campaign tracking.

- Data Analytics: Combining data from multiple sources for actionable insights.

Partnering with Marketing Experts

Smaller financial service providers can benefit from partnering with specialized marketing agencies. These partnerships provide access to expert teams equipped with the latest tools and techniques, ensuring effective and compliant marketing efforts.

Likewise utilzing platforms like Salesforce, with the assistance of an implementation expert like Tectonic sets you up for success.

Conclusion

Account-based marketing (ABM) offers a powerful, focused approach for financial services firms. By targeting high-value prospects and leveraging digital marketing strategies, financial service providers can enhance customer engagement, drive growth, and ensure compliance in a complex regulatory landscape.

Content updated June 2025.