Tectonic: Elevating Complaint Management in Banking with Salesforce

Customer satisfaction is key in banking, but complaints are unavoidable. Banking Complaints to Profits is not only learning from complaints but increasing revenue by them. Banking complaints also present a unique opportunity. Handled effectively, complaints can offer valuable insights that drive process improvements and ultimately strengthen customer relationships.

Banking Complaints to Profits

Banks need a robust, strategic complaint management system to capitalize on this opportunity. Such a system must go beyond simply documenting and resolving grievances. It must enable banks to proactively identify trends, assess root causes, and implement targeted solutions that address individual complaints and prevent future issues.

Salesforce offers a comprehensive platform that can transform your complaint management process. Let’s explore how its key features align perfectly with the needs of a strategic approach.

Streamlining Complaint Intake

Salesforce simplifies and customizes the process of collecting customer complaints, aligning with your specific policies and regulatory needs. Its dynamic intake process ensures a smooth and compliant experience for your customers and your team.

Efficient Complaint Lifecycle Management

Salesforce streamlines the entire complaint management process, ensuring seamless routing to the right teams and individuals for swift resolution. Automated assignments, milestone tracking, and clear follow-up expectations (including Service Level Agreements) guarantee accountability and efficiency at every stage. Automated escalations expedite resolutions when needed, ensuring regulatory compliance and maximizing customer satisfaction.

Securing Your Complaint Data

Salesforce prioritizes data security with Shield and Financial Services Cloud’s Compliance Data Sharing Model to ensure the confidentiality of sensitive complaint information through robust access controls and permissions. This guarantees that only authorized personnel can view and interact with sensitive data, maintaining the highest levels of privacy and compliance.

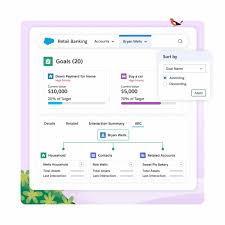

Centralizing and Unifying Your Data

Beyond security, Salesforce eliminates information silos by centralizing complaint data from across your organization. This creates a single source of truth, providing a comprehensive and unified view of customer feedback. This holistic perspective enables deeper analysis, informed decision-making, and a more proactive and practical approach to complaint management.

Harnessing Complaint Data for Continuous Improvement

Financial Services Cloud’s Case Management and Data Processing Engines can give you a complete view of customer complaints and their lifecycle. By harnessing this case data within CRM Analytics, you can enhance the customer 360, proactively monitor trends, prioritize areas for improvement, and enhance the customer experience while effectively mitigating risk.

The Future of Complaint Management: Salesforce as a Strategic Advantage

In an increasingly competitive and regulated landscape, banks must be equipped to address customer complaints efficiently and leverage them for continuous improvement. By combining Salesforce’s power with a strategic, customer-centric approach, banks can turn complaints into a catalyst for growth, ensuring a more resilient and customer-focused future.

At Tectonic, we’ve watched firsthand how a well-designed complaint management system can transform customer interactions from points of friction into opportunities for improvement. Our experience in the financial services sector has taught us that technology is only part of the equation. A comprehensive approach, encompassing data-driven insights, staff training, and ongoing process optimization, is essential for maximizing the benefits of any system.

Chat with our financial services experts to learn how Salesforce can transform your complaint management process to deliver exceptional service and strengthen trusted customer relationships.