Merchant Cash Advance Solutions: Enhancing Underwriting with Salesforce

In today’s fast-paced financial services industry, efficient and effective underwriting is more crucial than ever. Merchant cash advances (MCAs) have emerged as a popular alternative funding option for businesses that might not qualify for traditional loans. This insight explores how integrating Salesforce with MCA software can streamline underwriting, strengthen lender-borrower relationships, and boost overall operational efficiency.

Understanding Merchant Cash Advances

Merchant cash advances offer businesses upfront capital in exchange for a portion of future sales. Unlike traditional loans, MCAs are often easier to secure and come with flexible repayment options tied to daily credit card receipts. However, the unique structure of MCAs brings challenges to underwriting, due to the diversity in business models and cash flow patterns.

The Role of Underwriting in MCA

Underwriting is a vital step in the lending process, assessing the risk associated with providing funds to a borrower. For MCAs, underwriting involves evaluating a business’s revenue streams, creditworthiness, and overall financial health. Traditional underwriting methods can be cumbersome and slow, often causing delays in funding.

Challenges in Traditional Underwriting Methods

- Manual Processes: Many lenders still depend on manual data entry and paper-based documentation, increasing the risk of errors.

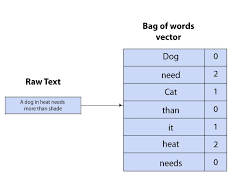

- Data Silos: Information scattered across different systems can impede comprehensive assessments.

- Slow Turnaround Times: Lengthy approval processes may discourage potential borrowers from seeking funding.

The Power of Salesforce in Streamlining Underwriting

Salesforce offers powerful solutions that integrate seamlessly with MCA software, effectively addressing these challenges:

- Automated Underwriting Software: Leveraging automated underwriting software within Salesforce allows lenders to speed up decision-making using predefined algorithms that assess risk based on real-time data analytics. This automation minimizes human error and enhances processing speed without sacrificing thoroughness.

- Centralized Data Management: Salesforce provides a centralized platform where all borrower information is securely stored. This integration enables underwriters to quickly access comprehensive profiles, eliminating data silos and ensuring informed decision-making based on complete financial histories.

- Enhanced Communication Tools: Salesforce’s customer relationship management (CRM) capabilities improve communication between lenders and borrowers throughout the underwriting process. Real-time updates and notifications keep both parties informed about application statuses and required documentation.

Benefits of Integrating MCA Software with Salesforce

- Improved Efficiency: Automating repetitive tasks significantly reduces manual workload, allowing underwriters to focus on high-value analyses rather than administrative duties.

- Faster Funding Decisions: Streamlined processes powered by Salesforce automation tools enable approvals within days instead of weeks.

- Enhanced Borrower Experience: A smoother application process builds trust between lenders and borrowers, which is critical for long-term relationships in finance.

- Scalability: As lending volumes grow, Salesforce’s cloud-based infrastructure supports scalability without requiring significant additional investment in IT resources or personnel.

Key Features to Look for in MCA Software Integrated with Salesforce

When choosing an MCA solution integrated with Salesforce, consider features such as:

- Real-Time Reporting & Analytics: For effective performance metric tracking.

- Customizable Workflows: Tailor workflows to meet specific business needs.

- Compliance Management Tools: Ensure adherence to regulatory standards throughout the underwriting process.

- Mobile Accessibility: Enable underwriters to access crucial information remotely, providing greater flexibility.

Conclusion

Integrating merchant cash advance solutions with Salesforce offers a transformative approach to streamlining underwriting processes in this niche financing sector. By automating workflows, centralizing data management, enhancing communication channels, and improving overall efficiency—all while ensuring compliance—lenders can gain a competitive edge and deliver exceptional service to their clients.

If you are searching for a Merchant Cash Advance, Underwriting, or financial services solution contact Tectonic today.