Private Lending Simplified: Unlocking Success with Salesforce

In the dynamic world of private lending, technology is transforming the way lenders operate. Salesforce stands out as a powerful platform, enabling private lenders to optimize processes, enhance borrower relationships, and drive sustainable growth. Let’s explore how Salesforce can simplify private lending and boost efficiency.

The Landscape of Private Lending and Its Challenges

Private lending refers to providing loans to individuals or businesses outside of traditional banks. While this approach offers flexibility and faster approvals, it also comes with challenges such as:

- Risk Assessment: Evaluating creditworthiness in non-traditional scenarios.

- Borrower Relationship Management: Maintaining strong, personalized connections.

- Regulatory Compliance: Navigating complex and evolving financial regulations.

Given these complexities, lenders need robust tools to manage the entire loan lifecycle effectively.

The Role of Loan Management Software in Private Lending

Loan management software is indispensable for automating and streamlining lending operations. Salesforce, with its flexible loan management capabilities, is particularly well-suited for private lenders. Key functionalities include:

1. Automated Underwriting

Salesforce enables automated underwriting by using predefined rules and algorithms to evaluate borrower eligibility. This speeds up decision-making, reduces manual errors, and ensures consistency.

2. Loan Processing

A centralized system in Salesforce allows lenders to track applications, manage documentation, and communicate with borrowers, ensuring no step in the process is overlooked.

3. Loan Servicing

Post-loan disbursement, Salesforce’s integration capabilities support repayment tracking, automated reminders, and delinquency management, ensuring seamless loan servicing.

Why Private Lenders Turn to Salesforce

Salesforce empowers private lenders with tools designed to optimize every stage of the lending process.

1. Customizable Solutions

Salesforce’s flexibility allows lenders to create workflows tailored to different loan types, whether it’s mortgage servicing or merchant cash advance (MCA) underwriting.

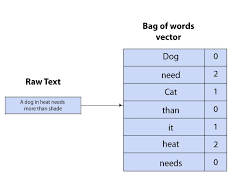

2. Advanced Data Management

With secure, cloud-based infrastructure, Salesforce ensures easy access to data anytime, anywhere. This not only enhances decision-making through analytics but also supports regulatory compliance.

3. Enhanced Customer Relationship Management (CRM)

Strong borrower relationships are key to private lending success. Salesforce’s CRM tools help lenders manage interactions from initial inquiries to post-loan follow-ups, ensuring clients feel supported throughout their journey.

4. Seamless Integration

Salesforce integrates effortlessly with other financial tools, such as microfinance platforms and construction loan management software, creating a unified ecosystem for managing diverse loan portfolios.

Choosing the Right Loan Management Solution

When adopting Salesforce or similar platforms for private lending, consider the following:

- Scalability: Ensure the solution grows with your business.

- Ease of Use: Choose software with an intuitive interface for both employees and borrowers.

- Robust Support: Partner with providers that offer reliable customer service and training.

For private lenders, specialized solutions like Fundingo, built on Salesforce, can take operational efficiency to the next level.

Conclusion

Salesforce is transforming private lending by simplifying operations and strengthening lender-borrower relationships. With tools to manage the entire loan lifecycle—from underwriting to servicing—private lenders can increase efficiency, maintain compliance, and enhance customer satisfaction.

Adopting advanced technologies like Salesforce positions private lenders for long-term success in an increasingly competitive market.

Are you ready to harness the power of Salesforce for your private lending business? Let’s connect and explore how Tectonic can streamline your processes.

🔔🔔 Follow us on LinkedIn 🔔🔔