Loan Origination Salesforce

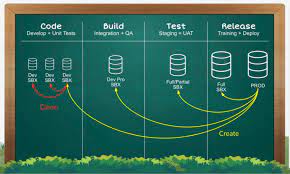

Salesforce Loan Origination: Unlocking Efficiency and Growth Implementing a CRM is a deal-changing decision for any retail mortgage brokerage. In a digital landscape dominated by loan origination platforms like Ellie Mae Encompass, Nortridge, Calyx, and Fiserv, staying lean and nimble is crucial. Understanding how to leverage Salesforce with your loan origination system (LOS) lays the groundwork for a streamlined future, empowering clients, partners, and employees. The suite of productivity and marketing tools Salesforce offers is key to your organization’s success. Remember, Rome wasn’t built in a day, and skilled architects with the right tools made it possible. Let’s explore the benefits of Salesforce in loan origination. Enhancing Prospecting, Referrals, and Marketing Once you’ve built an efficient loan origination machine, it’s time to fuel it. Salesforce integrates seamlessly with referral and channel partners like Bankrate, Zillow, and Realtor.com, feeding prospects directly into your marketing and loan origination funnel. Using tools like Web to Lead or Salesforce’s robust web service APIs, prospects can flow into your CRM in real time. Partner Communities can create portals for third parties to refer and manage their pipelines. Salesforce Marketing Cloud automates journeys, showcasing your company’s value and maintaining constant contact. Qualify prospects effectively by running their credit before they hit your LOS, reducing noise and understanding the quality each lead source brings. This maximizes marketing dollars and focuses efforts where they matter most. Streamlining the Sales Funnel Capturing leads is just the beginning. The real challenge is keeping them and ensuring they choose your business. Salesforce helps visualize your pipeline and accelerates the process with reminders, tasks, texts, emails, calls, and other automation tools. Einstein Analytics and AI provide insights into the most effective strategies, calculate close rates, and help forecast revenue streams accurately. Stay nimble. Not all prospects are tech-savvy, but you can use technology to enhance communication with them. Empowering Loan Officers Mortgage companies often aim to improve customer experience with new systems. However, empowering loan officers and ensuring their satisfaction is equally critical. Salesforce provides loan officers with a 360-degree view of their prospects, enabling them to pull client credit from mobile devices and drastically improve productivity and close rates. Salesforce Mobile places the entire origination process at their fingertips, anywhere and anytime. Integrations with web analytics offer insights into prospect behavior, allowing tailored conversations. A CRM that consolidates contact history creates a powerful ally, ensuring personalized experiences. Integrating Systems with Tectonic Integrating a loan origination system like CalyxPoint, Fiserv, or Ellie Mae Encompass can be daunting. Clients often rush to modernize, but the key is to take it step by step. Define a moment when the loan flows from Salesforce to the LOS, typically once a prospect is qualified. Updates, such as loan milestones and underwriting requests, can flow back into Salesforce, while changes to the loan document itself should occur in the LOS. Gradually progress towards a synchronized, bi-directional state to ensure success and buy-in. Leveraging Customer and Referral Portals Salesforce Customer Community: A drag-and-drop customer portal can sit on top of real-time data, understanding each customer’s loan lifecycle stage and dynamically adapting to drive desired behaviors. Use it to solicit additional documents or update loan statuses as they progress through milestones. Salesforce Partner Community: Real estate agents, insurance companies, and law firms are vital to a mortgage company’s referral system. Salesforce Partner Communities offer a portal to share relevant information with partners, creating a boutique experience that enhances referrals. Building Lifelong Client Relationships A fully funded loan is not the end; it’s the beginning of a new journey. The referral and refinancing process starts as soon as the origination process ends. Maintaining regular contact and demonstrating partnership should be core values for any mortgage company. Taking out a mortgage is one of the largest financial decisions most people make, and positive experiences can have a lasting impact. Leveraging Salesforce CRM and Marketing Cloud journeys helps keep relationships alive, ensuring a steady pipeline for years to come. Always remember the importance of first impressions and the long-term value of satisfied clients and partners. Like Related Posts Salesforce OEM AppExchange Expanding its reach beyond CRM, Salesforce.com has launched a new service called AppExchange OEM Edition, aimed at non-CRM service providers. Read more The Salesforce Story In Marc Benioff’s own words How did salesforce.com grow from a start up in a rented apartment into the world’s Read more Salesforce Jigsaw Salesforce.com, a prominent figure in cloud computing, has finalized a deal to acquire Jigsaw, a wiki-style business contact database, for Read more Health Cloud Brings Healthcare Transformation Following swiftly after last week’s successful launch of Financial Services Cloud, Salesforce has announced the second installment in its series Read more