Optimizing Public Sector Loan Management with Salesforce

Effective loan management is vital for public sector financial operations, ensuring that funds are allocated efficiently and responsibly. As public entities face increasing demands for transparency and accountability, leveraging technology becomes essential. Salesforce, a leading customer relationship management (CRM) platform, offers robust solutions tailored to enhance loan management processes in the public sector. This article explores how Salesforce optimizes key aspects of loan management, with a focus on the Loan Boarding, Handoff, and Approval Process.

Understanding Loan Boarding in Public Sector Finance

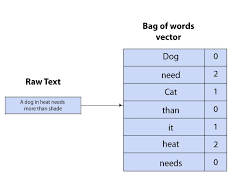

Loan boarding refers to the initial steps of creating a new loan within an organization’s financial system. In the public sector, where loans often involve multiple stakeholders and complex regulations, a streamlined boarding process is critical. Salesforce’s customizable workflows and automation capabilities enable organizations to reduce manual entry errors and improve overall efficiency.

Streamlined Data Entry

Salesforce allows organizations to create custom fields that capture essential data points, such as borrower information, loan amounts, interest rates, and terms. When a loan application is submitted through a portal integrated with Salesforce, the platform automatically populates relevant fields, minimizing repetitive data entry and human error.

Enhanced Collaboration

Salesforce’s collaborative features, like Chatter, enable seamless communication between departments, such as finance, compliance, and risk management. Teams can access real-time information and discuss applications directly on the platform, eliminating the need for delays caused by emails or meetings and expediting the approval process.

The Handoff Process: Ensuring Smooth Transitions

Once a loan application is successfully boarded, it must be handed off to various stakeholders for review and approval. Without proper management, this process can become bottlenecked. Salesforce provides tools that automate notifications and reminders, ensuring smooth handoffs at each stage of the approval process.

Automated Alerts and Task Management

Salesforce’s task management system assigns specific tasks to team members and sets deadlines for completion. Automated alerts ensure no step in the approval process is overlooked, minimizing delays caused by human error or oversight and keeping the process on track.

Approval Process: Simplifying Decision-Making

In public sector lending, the approval process often requires multiple levels of scrutiny due to regulatory requirements. Salesforce’s powerful reporting capabilities allow decision-makers to quickly analyze applications based on predefined criteria, such as creditworthiness and compliance metrics.

Custom Approval Workflows

Salesforce enables organizations to design custom workflows that reflect their unique approval hierarchies. For instance, loans that require additional scrutiny based on size or risk can easily be routed to the appropriate stakeholders, ensuring compliance and mitigating risks.

Document Management: Keeping Everything Organized

Effective loan management relies on accurate documentation throughout the loan lifecycle, from application to repayment. Salesforce’s document management features enhance organization and compliance:

- Centralized Storage: All loan-related documents—applications, agreements, correspondence—are securely stored within individual loan records.

- Version Control: Version control ensures that all stakeholders access the most current documents, preventing confusion over outdated files.

- Compliance Tracking: Automated reminders ensure that all required documentation is in place, helping organizations meet legal standards governing public financing.

Conclusion

Optimizing public sector loan management with Salesforce offers substantial benefits in efficiency, accountability, and adaptability. From seamless loan boarding to enhanced collaboration, streamlined approvals, and robust document management, Salesforce provides a comprehensive solution for public sector financial operations.

By leveraging these technological advancements, public sector organizations can effectively manage loans from application to repayment, ensure compliance, and build trust with the constituents they serve. Salesforce’s capabilities position public entities for operational success while maintaining the high standards required for public financing.