Return on Sales (ROS): Definition, Calculation & How to Improve It

Want to know how efficiently your business converts sales into profit? Who doesn’t? Return on Sales (ROS) measures operational efficiency, helping you maximize earnings and identify wasteful spending.

Even profitable businesses can struggle with cash flow if they overspend on marketing, R&D, or other expenses—leaving little profit despite high revenue. ROS answers: “How much profit do we keep from each dollar of sales?”

Let’s break down what ROS is, how to calculate it, and strategies to improve it.

What Is Return on Sales (ROS)?

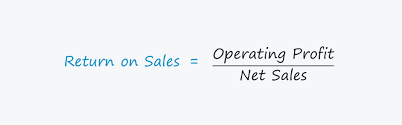

Return on Sales (ROS) is a profitability ratio that shows how much of your revenue turns into operating profit. Also called operating profit margin, it excludes interest and taxes, focusing purely on operational efficiency.

Formula: ROS=(Operating ProfitNet Sales)×100ROS = (Net SalesOperating Profit)×100

- Expressed as a percentage

- Used to track performance over time or compare against competitors

- Key metric for investors and business leaders assessing efficiency

ROS vs. ROI vs. Net Profit Margin

| Metric | What It Measures | Key Difference |

|---|---|---|

| ROS | Profit from operations (before interest & taxes) | Focuses on operational efficiency |

| ROI (Return on Investment) | Profit generated from an investment | Measures effectiveness of capital spent (e.g., new equipment, marketing) |

| Net Profit Margin | Profit after all expenses (taxes, interest, etc.) | Shows final profitability after all costs |

How to Calculate ROS

Step-by-Step Formula

- Calculate Net Sales = Gross Sales – (Returns + Discounts + Allowances)

- Determine Operating Profit = Net Sales – COGS – Operating Expenses

(Excludes interest & taxes) - Divide Operating Profit by Net Sales

- Multiply by 100 to get a percentage

Example Calculation

| Item | Amount |

|---|---|

| Revenue | $10,000,000 |

| Returns | $1,000,000 |

| COGS | $2,000,000 |

| Operating Expenses (SG&A) | $4,000,000 |

| Operating Profit | $3,000,000 |

| Net Sales | $9,000,000 |

ROS = (3,000,0009,000,000)×100=∗∗33.3%∗∗ROS=(9,000,0003,000,000)×100=∗∗33.3%∗∗

What Is a Good ROS?

It depends on your industry. Here are average benchmarks:

| Industry | Average ROS |

|---|---|

| Healthcare | 6-30%* |

| Hotels | 8-15% |

| Manufacturing | 6-8% |

| Restaurants | 3-7% |

| Retail | 2-5% |

| Tech | 10-20%+ |

*Higher for specialized services (e.g., surgical centers at 30%)

Key Insight: If ROS declines as revenue grows, your costs may be rising too fast.

5 Ways to Improve Your ROS

1. Optimize Pricing Strategy

- Test value-based pricing (charge based on perceived value)

- Use dynamic pricing (adjust based on demand)

- Avoid cost-plus pricing (can lead to lost competitiveness)

2. Reduce Costs

- Renegotiate supplier contracts

- Cut wasteful spending (e.g., inefficient marketing)

- Automate processes to lower labor costs

3. Boost Operational Efficiency

- Streamline production/supply chain

- Use sales automation to reduce overhead

- Eliminate non-value-adding tasks

4. Improve Sales Process

- Better lead qualification → higher close rates

- Enhance digital sales experience

- Reduce sales cycle time

5. Lower Customer Acquisition Cost (CAC)

- Improve customer retention (cheaper than new sales)

- Use sales analytics to target high-converting leads

- Optimize ad spend & sales routes

- Utilize more accurate pipeline forecasts

Why ROS Matters

- Identifies inefficiencies in operations

- Helps secure financing (shows ability to repay loans)

- Guides pricing & cost-cutting decisions

- Benchmarks performance vs. competitors

Pro Tip: Monitor ROS quarterly—if it drops, investigate rising costs or pricing issues.

Summary

ROS is a powerful metric for assessing how well your business turns sales into profit. By optimizing pricing, cutting costs, and improving efficiency, you can increase profitability and ensure sustainable growth.