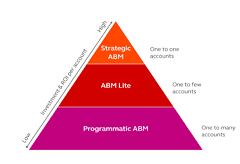

Financial services marketers operating in a Business to Business environment are adopting a proactive approach to address key business challenges and drive growth. These challenges encompass complex data management, cumbersome legacy systems, limitations in email platforms, budget constraints, technical debt, and limited flexibility due to stringent industry regulations. In addition to overcoming these challenges, financial services businesses must establish robust relationships with buying committees to influence decision-makers and consistently meet their unique needs. Account based marketing financial services is a key tool for addressing these challenges.

Tectonic has a strong track record optimizing Salesforce and customizing for the Financial Services industry. One solution we recommend is to tackle these challenges is the adoption of account-based marketing (ABM), which prioritizes quality account development over quantity.

By pinpointing their ideal customers and tailoring marketing strategies accordingly, account based marketing financial services marketers can create precise and personalized campaigns, avoiding a trial-and-error approach. Laser focused marketing warms and converts leads faster. While casting a wide net for lead generation builds a large database, it may not necessarily fill a healthy pipeline.

ABM Financial Services

ABM involves personalizing the customer experience to drive conversions. Personalized communication is the conversation leading to conversion. This is simply customizing approaches for each buyer and scenario, from agents to wealth management advisors and brokers to relationship managers. Delivering personalized content and experiences across various digital spaces and channels, including your websites, customer portals, and email campaigns, helps establish trust and cultivate meaningful relationships with prospects, ultimately increasing the likelihood of conversion.

All businesses have great marketing collateral that generates and even warms leads. ABM content targets very specific audiences based on look-alike customers.

Successful implementation of account-based marketing requires financial services businesses to align their marketing, sales, and service teams. This involves streamlining marketing efforts toward key accounts and automating personalized engagement for the entire book of business. By doing so, businesses can effectively acquire and grow key accounts while optimizing performance, efficiency, and spending.

A significant benefit of ABM is its capacity to extract deep insights from customer data. By analyzing this data, businesses can identify trends and patterns that steer strategic decision-making. Knowledge of a customer’s website browsing behavior can empower customer-facing representatives when approaching clients with the next best offer. Leveraging insights from customer interactions allows financial services businesses to create customer-centric ABM strategies.

Despite the challenges inherent in marketing within the financial services sector, ABM is a solution for personalizing engagement. Account based marketing fosters strong relationships and drives growth.

If your financial services organization is exploring account based marketing strategies, Tectonic can help.