Simplifying Repayment Schedules: Elevating Borrower Experience with Salesforce

In the rapidly changing financial services industry, managing loan repayment schedules efficiently is vital for both lenders and borrowers. A well-designed system can significantly enhance the borrower experience, streamline operations, and boost overall efficiency. Salesforce software emerges as a powerful solution that simplifies repayment schedules and fosters better communication between lenders and borrowers. This article explores how Salesforce can revolutionize repayment management with its comprehensive features.

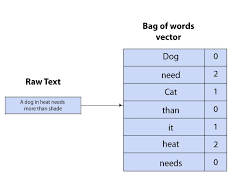

Understanding Repayment Schedules

Repayment schedules define how a borrower will pay back their loan over time, detailing payment amounts, due dates, interest rates, and the total loan duration. A clear and well-structured repayment schedule not only helps borrowers manage their finances but also ensures that lenders receive timely payments.

The complexity of repayment schedules can vary based on factors like loan terms, interest rates, and borrower profiles. Therefore, having an effective system to manage these variables is crucial for maintaining accuracy and transparency throughout the borrowing process.

The Role of Salesforce in Loan Management

Salesforce offers an extensive suite of tools designed to enhance customer relationship management (CRM) across various industries, including finance. By utilizing Salesforce’s capabilities, lenders can develop customized solutions that address key aspects of loan management, such as:

1. Automated Amortization Schedules

Salesforce enables the automated creation of amortization schedules tailored to individual loans. This feature minimizes manual errors and ensures accurate calculations from the start. Automation allows lenders to provide borrowers with clear payment plans, including details on principal reductions and interest accruals over time.

2. Custom Borrower Portals

One of Salesforce’s major strengths is the ability to create custom borrower portals. These portals allow clients to access their repayment schedules anytime, view upcoming payments, track their balances in real-time, and even make payments through secure channels. This transparency builds trust between lenders and borrowers, enhancing overall satisfaction.

3. Document Management

Effective document management is essential for maintaining organized records related to loans and repayments. Salesforce’s document management features enable lenders to securely store important documents—such as contracts, amendments, or communications—within each borrower’s profile. This accessibility simplifies audits and reviews while ensuring compliance with regulatory standards.

Streamlined Communication with Automated Alerts

A common challenge for borrowers is keeping track of payment deadlines and understanding when payments are due. Salesforce addresses this by offering automated alerts via email or text message, reminding borrowers of upcoming due dates or changes in payment schedules.

These notifications help keep borrowers informed about their obligations without overwhelming them, balancing proactive communication with user-friendliness.

Enhanced Reporting & Analytics

Salesforce provides powerful reporting tools that allow lenders to effectively analyze repayment patterns across different portfolios. By identifying trends related to timely payments, defaults, or late fees, financial institutions can strategically tailor their offerings.

Detailed dashboards also present key performance indicators (KPIs) related to collection efficiency, aiding in risk assessment and decision-making processes.

Portfolio Management Integration

Integrating portfolio management features within Salesforce allows lenders to monitor individual loans and gain insights into overall portfolio health. This includes tracking repayments received versus outstanding balances owed by all clients collectively.

This holistic view supports decision-making around refinancing options for struggling clients and identifying growth opportunities based on historical data trends. This integration enhances lender profitability while improving borrower experiences.

Conclusion: Transforming the Borrower Experience

Integrating Salesforce software into loan repayment scheduling represents a significant advancement in enhancing borrower experiences in the financial services industry. From automating complex amortization calculations to providing personalized customer portals, Salesforce empowers both lenders and borrowers at every stage of the process.

By embracing technology like Salesforce, lenders can streamline communication, reduce administrative burdens, and position themselves favorably against competitors. This buildss long-lasting relationships built on trust and reliability, ultimately benefiting all parties involved.

Contact Tectonic today to explore lending solutions from Salesforce.